Gift Tax Exclusion 2025. There's no limit on the number of individual gifts that can be. Firstly, it’s essential to note that the annual gift tax exclusion applies only to the gifts you give to an individual each year, not the total amount of gifts.

Annual gift tax exclusion has increased currently, you can give any number of people up to $17,000 each in a single year without taxation. In general, it’s bad to get in the habit of severing.

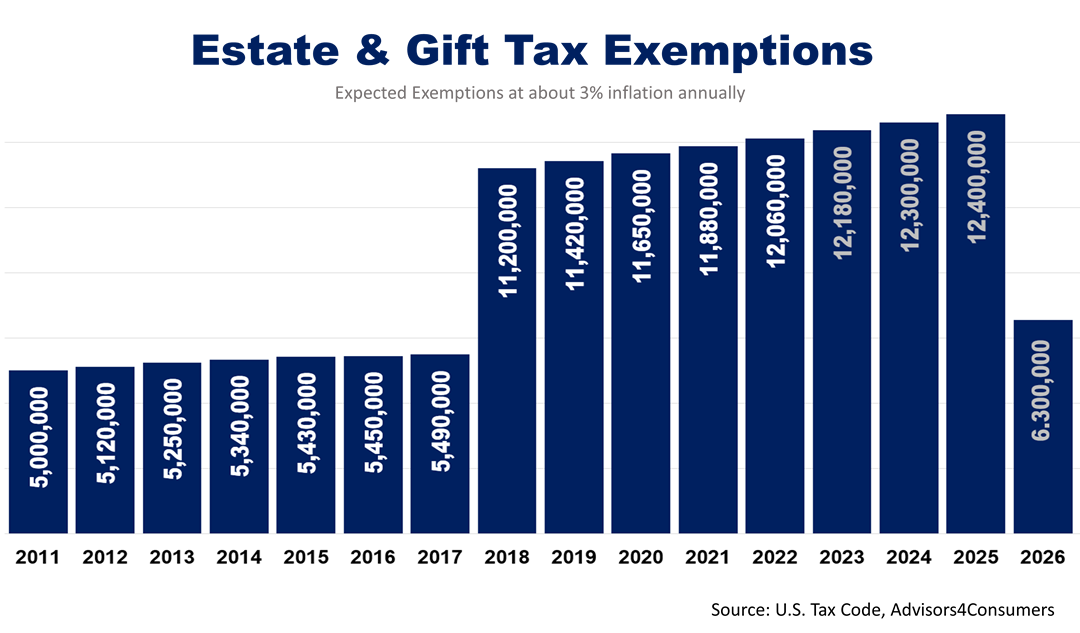

The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The annual exclusion from gift tax (i.e. The gift tax exclusion limit for 2025 was $16,000, and for 2025 it’s $17,000.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, This is the amount one can gift to a recipient during the year without filing a gift tax return. The faqs on this page provide details on how tax reform affects estate and gift tax.

IRS Increases Gift and Estate Tax Thresholds for 2025, Estate and gift tax faqs. The annual gift tax exclusion will increase from $17,000 to $18,000 in 2025.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, It is one of many irs provisions that is adjusted annually for inflation. The revenue act of 1924 first introduced.

Annual Gift Tax Exclusion Amount Increases for 2025 News Post, In general, it’s bad to get in the habit of severing. For 2025, the annual gift tax limit is $18,000.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, Client ($36,000.00 for a u.s. There's no limit on the number of individual gifts that can be.

Federal Estate and Gift Tax Exemption set to Rise Substantially for, The annual gift tax exclusion allows. How the annual gift tax exclusion works?

Gift Tax Exemption 2025 & 2025 How It Works, Calculation, & Strategies, The lifetime gift tax limit for 2025 is $13.61 million, up from $12.91 million in 2025. The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

ACG product ALIS News 2025 Estate & Gift Tax Planning For Large, The gift tax exemption limit has increased for 2025, allowing individuals to give up to $18,000 per person without incurring taxes. Annual gift tax exclusion has increased currently, you can give any number of people up to $17,000 each in a single year without taxation.

Increases to 2025 Estate and Gift Tax Exemptions Announced Varnum LLP, This is the dollar amount of taxable gifts that each person can. Beginning on january 1, 2025, an individual may make gifts in an amount up to $18,000, in total, on an annual basis to any recipient without making a taxable gift, and married.