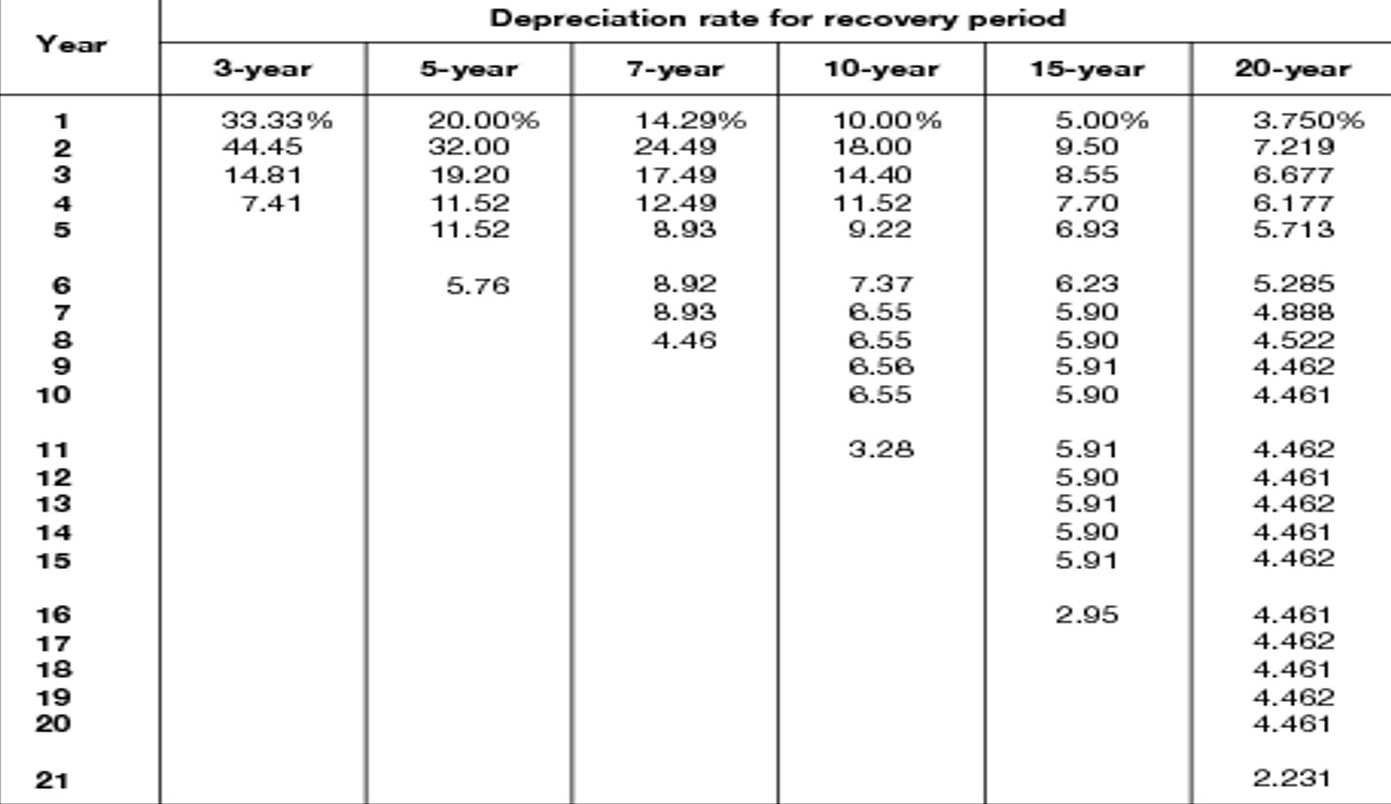

Irs Car Depreciation 2025. Calculate car depreciation by make or model. (1) two tables of limitations on depreciation deductions for owners of passenger automobiles placed in service by the taxpayer.

The depreciation deduction limits in tables 1 and 2 apply to passenger automobiles, other than leased passenger automobiles, that are placed in. Calculating your standard mileage deduction.

For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2025, and before january 1, 2025, you can elect to take a special.

![How to Get 100 Auto Tax Deduction [Over 6000 lb GVWR] IRS Vehicle](https://i.ytimg.com/vi/Ce-xd007kkc/maxresdefault.jpg)

How to Get 100 Auto Tax Deduction [Over 6000 lb GVWR] IRS Vehicle, Irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. Car depreciation by make and model.

IRS Announces Depreciation and Lease Inclusion Amounts on Vehicles for, For 2025, the deduction limit is $1,220,000, with a total equipment spending cap of $3,050,000. See new and used pricing analysis and find out the best model years to buy for resale value.

Review Of How To Calculate Car Depreciation Value In India Ideas, As of 2025, the deduction for vehicles weighing between 6,000 and 14,000 lbs has been adjusted. The irs has issued the luxury car depreciation limits for business vehicles placed in.

What is Car Depreciation? Holts, Irs tax topic on deductible car expenses such as mileage, depreciation, and recordkeeping requirements. See new and used pricing analysis and find out the best model years to buy for resale value.

How to Use Car Depreciation to Your Advantage Metromile, 2025 auto depreciation caps and lease inclusion amounts issued, rev. For 2025, it's set to increase to $0.67 (67 cents).

Irs depreciation calculator GerryFarhaan, For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2025, and before january 1, 2025, you can elect to take a special. Calculating your standard mileage deduction.

Formulario 4562 depreciation and amortization Actualizado septiembre 2025, (1) two tables of limitations on depreciation deductions for. The biggest benefit of the current auto deduction is the strategy of bonus depreciation.

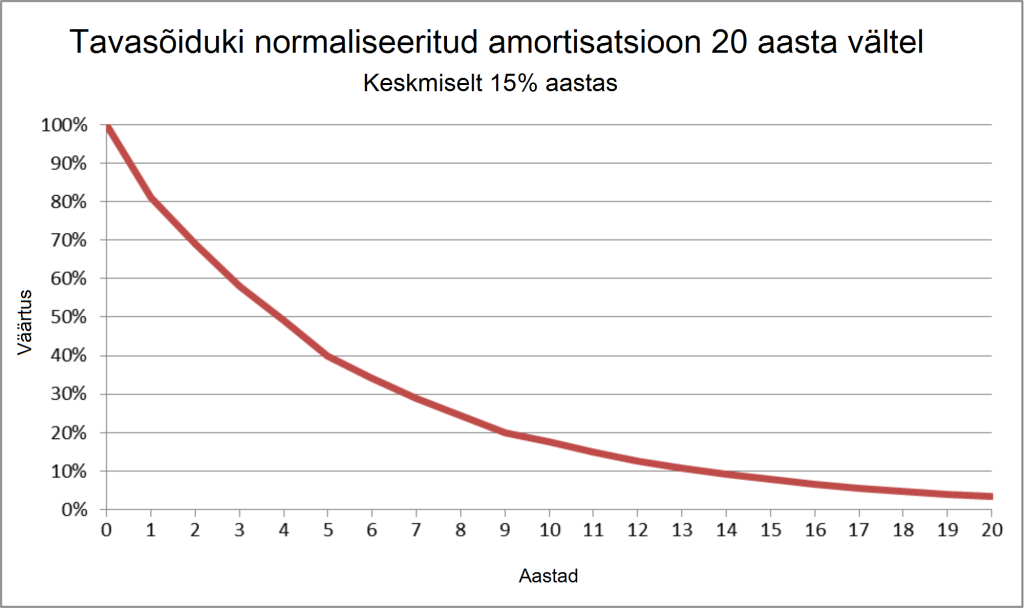

Auto ostmisega seonduvad kulud Autosky, Phase down of special depreciation allowance. The basis (purchase price + additional fees and taxes) of the vehicle is $40,000.

Car Depreciation What Are the Risks? CRS Automotive Hamilton, The irs has released ( rev. The basis (purchase price + additional fees and taxes) of the vehicle is $40,000.

Vehicle Depreciation All you need to know! Vinsure Insurance Brokers, The biggest benefit of the current auto deduction is the strategy of bonus depreciation. Please explain “used property” as it relates to bonus depreciation.